Over the past decade, Sub-Saharan Africa has been increasingly adopting one of the most potent modern-day miracles of our mobile-phone saturated world — mobile money.

As of today, Sub-Saharan Africa now boasts over 548 million registered users, which account for nearly 50% of all mobile money users on the planet, according to the GSMA 2021 Mobile Money report, making the region not only a world leader, but the dominant bellwether for the global industry.

Much of this growth has occurring over the past few years, thanks to a coalition of fortuitously aligning ingredients — naturally vast demand from unbanked people, the world’s fastest mobile phone penetration growth (standing at 4.6% annual growth in 2020), and the sudden rise of availability with mobile network-focused APIs and related infrastructure.

Flutterwave, a leading payment gateway infrastructure provider in Africa, is essentially the glue helping to plug together the world’s fastest-growing mobile money market, in turn supporting economic growth across the continent.

Earlier in August 2021, we set out to bring developers, PMs and designers together with the sole aim of having them create solutions to some of the main social issues today, including those presented by growing mobile money usage in Africa. We challenged them to innovate around these issues using Reloadly, Flutterwave, and their diverse skill sets, backgrounds and experiences.

To get a full grasp on the state of mobile money in Sub-Saharan Africa today, we spoke with Azeez Oluwafemi, Head Product Engineering and Innovation at Flutterwave, who sees his company as playing a critical role in connecting the region’s economies through mobile money.

“Payments drive commerce and logistics,” says Oluwafemi. “This means more people have the opportunity to engage in cross-border transactions and commerce, resulting in more goods to be hauled across countries. The end result is prosperity for the continent.”

In our interview, Oluwafemi also speaks about Africa’s growing developer talent pool, as well as mobile money’s potential to touch all people on the continent, portending high-impact industry growth that shows no signs of slowing.

[If you are interested in mobile money APIs in Africa, you’ll also enjoy this interview with the Founder and CEO of MFS Africa, Dare Okoudjou.]

Reloadly: We’ve heard the CEO and Founder of Flutterwave say that “Africa needs three major things: logistics, payments, and commerce.” How is mobile money in Africa — which is experiencing among the highest growth rates in the world — destined to help connect the fragmented nature of Africa? And why do you believe this segment is growing so quickly?

Oluwafemi: Today, mobile penetration in Africa is the fastest growing in the world. This in turn supports the growth of mobile money penetration on the continent. The focus of businesses, governments and regulators in Africa on financial inclusion means that Flutterwave is tasked with thinking of better ways to usher the unbanked into the financial ecosystem so they can access other benefits, such as credit facilities.

Mobile money is a key method we have identified, which has the potential to reach all parts of the continent, rural and urban. Our infrastructure supports international payments processing across the world, and Flutterwave has developed partnerships with major mobile money providers, such as M-pesa, which offers an M-pesa user in Nairobi the superpower to pay a business in Lagos on Flutterwave. That way, we have connected various payment methods into one infrastructure for the purpose of growing businesses and the prosperity of the continent.

Payments drive commerce and logistics. In recent times, we have partnered with MTN and M-pesa who both have a combined reach of 100 million active users. This means that more people have the opportunity to engage in cross-border transactions and commerce, resulting in more goods to be hauled across countries. The end result is prosperity for the continent.

Reloadly: “Africa is not a country, but we make it feel like?one,” is an important quote from Flutterwave. Can you explain to our community of business leaders and developers how Flutterwave works to complete this mission of unifying Africa’s payment systems? How does mobile money fit in?

Oluwafemi: We simplify payments through our simple and powerful API, which works like a highway connecting other niche and efficient in-country payment methods like mobile money, cards, mobile wallets etc. We make Africa seem like a country by ensuring that a person in Nairobi using M-pesa can easily pay a person in Lagos via Flutterwave.

Africa has the world’s most active mobile money users. This means that more and more people in Africa own and operate mobile money accounts. It makes sense that we offer customers of businesses who are our merchants the opportunity to conveniently pay for products and services online with their smartphones anywhere, anytime.

We have partnered with key mobile money providers across various markets like Safaricom and MTN to foster this mission. This means more distribution, more customers for African businesses and more financial inclusion for the continent’s economy.

Reloadly: The world can learn a lot from Africa’s experience in mobile money. Flutterwave is planning to expand into North Africa and has now developed a global brand. What lessons that you have learned in Sub-Saharan Africa — which has leapfrogged traditional banking into mobile payments — can also be applied to North Africa and other parts of the world where mobile payment systems still aren’t being highly leveraged?

Oluwafemi: Every region has its unique payment challenges and solutions. Mobile money is an innovation created in service to the unbanked and underbanked in East Africa and has quickly spread to other parts of Africa. North Africa is an entirely different market with its own complexities and needs.

If the market needs mobile money integrations, then we will provide that as we are always looking for efficient ways to grow the businesses of our merchants. We will always prioritise our customers and their customers in providing solutions that make life easier and payments more convenient for them as they grow their business.

Reloadly: Flutterwave recently partnered with Reloadly to run a hackathon using their respective payment and airtime top-up APIs, which quickly got a lot of attention from Africa’s developer community. What is your experience and opinion of Africa’s talent pool of developers — education and innovation-wise — and how will up-and-coming coders help influence the future of mobile money on the continent?

Oluwafemi: Africa has an abundance of tech talent that are leveraging emerging technological advancements to create digital solutions and products for Africans and by Africans. The innovation and ingenuity of our people are directly linked to the continent being regarded as a budding tech hub.

The Flutterwave and Reloadly hackathon offers African Developers and Builders the opportunity to hone their skills while earning experience that helps them become better builders and innovators.Technological innovation thrives on skills and talent, and the more excellence we encourage in the continent the better for the payments and mobile money ecosystems.

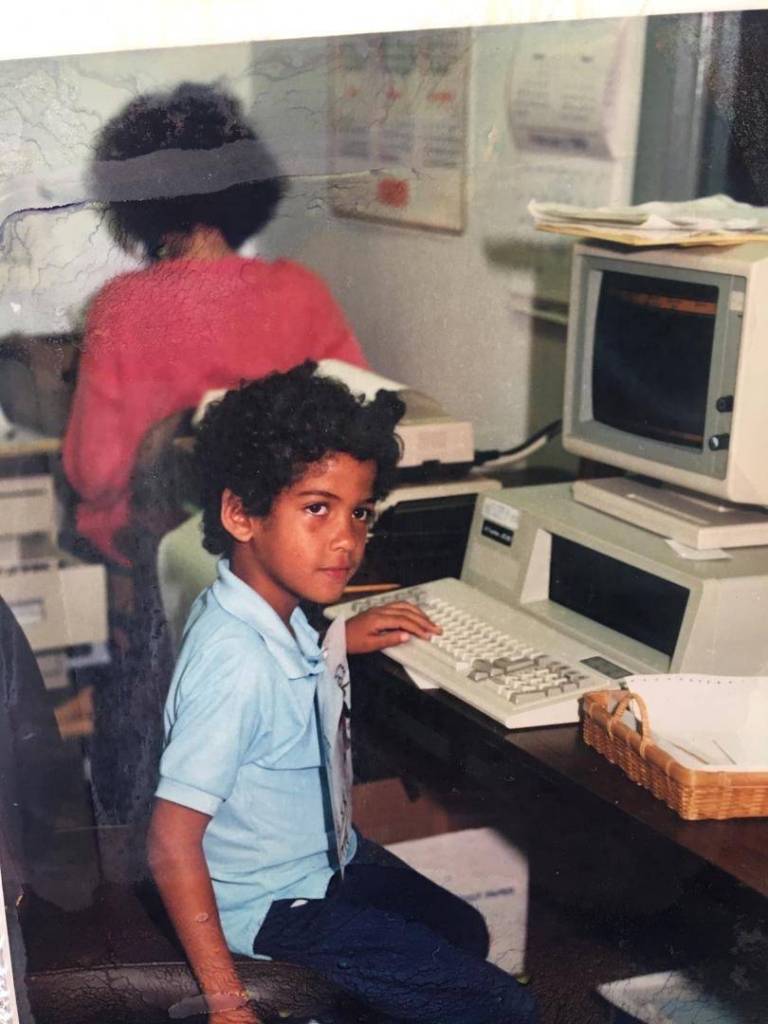

The interns of today are the CTOs and Engineering Managers of tomorrow. It makes sense that we discover these talented people early enough and give them the right opportunities to thrive in order to move our ecosystem forward, now and into the future.

Reloadly: What are the biggest roadblocks/challenges to developing a less fragmented mobile money system in Africa, and how is Flutterwave — as well as partners like Reloadly — jointly helping to solve this?

Oluwafemi: What could have been regarded as challenges in the past are what we see as opportunities for growth in Africa’s mobile money market. We are always building trust capital with our stakeholders including but not limited to partners, regulators, users, the general public etc.

Mobile money operators, payment providers as well as other partners like Reloadly are building relationships with their stakeholders—more can be done. As an industry, people are yet to fully grasp what we’re building. It makes sense to carry them along effectively to ensure faster adoption and uptake.

We can build even more trust capital through trust-based marketing, building resilient and reliable products that protect the user, efficient data security and compliance processes, proactive engagement with regulators and partners, and more.

At Flutterwave, we do all these and more because we value our customers and need them to understand our mission, goals and solutions at all times—we need them to continue to trust us.

Reloadly: Finally, what is the current Big Hairy Goal that you are working on, be it for Fluttewave or otherwise? What does this tell us about your ultimate vision for payments and Africa?

Oluwafemi: There are plenty of opportunities for growth and innovation in the business and payments ecosystems across Africa. We are continuously researching and creating solutions that provide endless possibilities for businesses and individuals in the continent.

Flutterwave is now exploring various high-powered partnerships, expansions and product launches that will further support our customers in their in-country growth and cross-border expansions. We will let the world know when the right time comes.